10 Share tips to build wealth in long term. Best stocks to pick in Indian market.

1. Invest in blue-chip companies with a strong track record of consistent growth and earnings, such as Reliance Industries, HDFC Bank, and Tata Consultancy Services.

2. Focus on companies in high-growth sectors such as e-commerce, healthcare, and renewable energy, such as Infosys, Dr. Reddy’s Laboratories, and Tata Power.

3. Look for companies with a strong competitive advantage or moat, such as Asian Paints, Nestle India, and Bajaj Finance.

4. Consider investing in companies that are likely to benefit from government initiatives, such as Bharat Petroleum Corporation, NTPC Limited, and Larsen & Toubro.

5. Invest in companies with a proven management team and a sound strategy for growth, such as HCL Technologies, Kotak Mahindra Bank, and Hindustan Unilever Limited.

6. Look for companies with a strong dividend payout history, such as Hindustan Zinc, Coal India, and NMDC Limited.

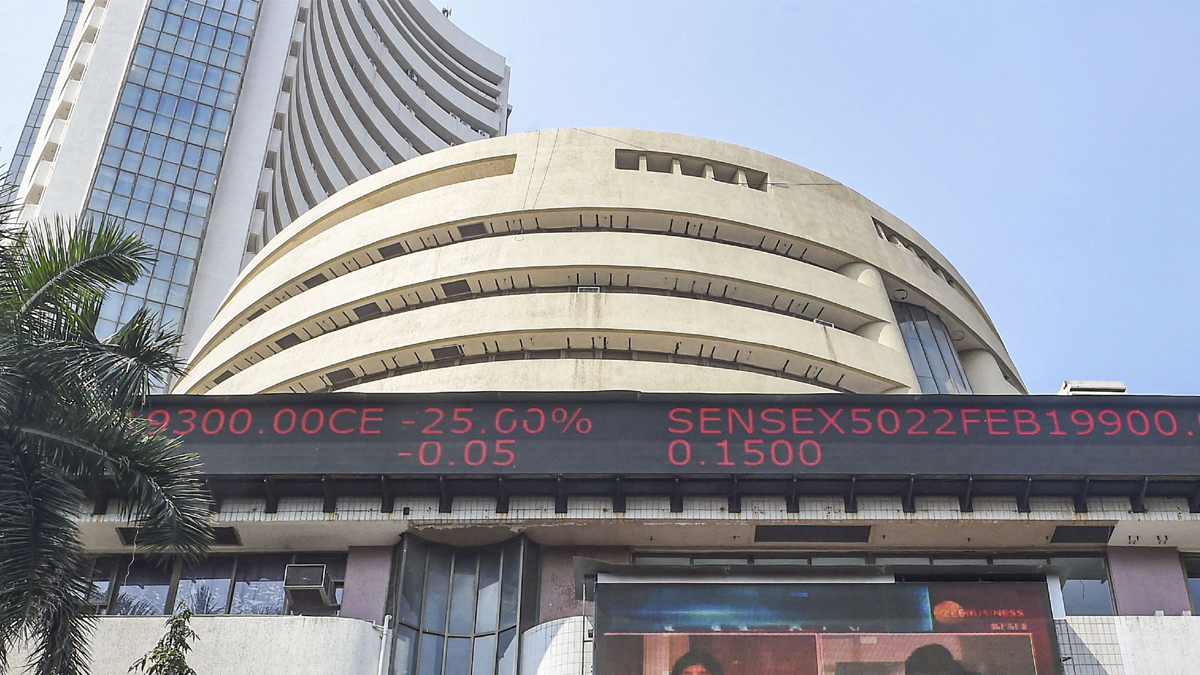

7. Consider investing in exchange-traded funds (ETFs) that track the performance of the broader Indian market, such as the Nifty 50 or the BSE Sensex.

8. Research companies that have a dominant market share in their respective industries, such as Maruti Suzuki India, HDFC Life Insurance, and Godrej Consumer Products.

9. Look for companies that have a strong balance sheet and low debt-to-equity ratio, such as Bharat Electronics, Infosys, and Tata Steel.

10. Consider investing in companies that have a strong presence in international markets, such as Tata Motors, Wipro, and Mahindra & Mahindra.